Median house price: $569,000 (April 2023 – March 2024), Up 26.4% in the last 12 months

Median house rental value: $575 PW (April 2023 – March 2024), Up 15.0% in the last 12 months

Transport: car, train, bus

Population: 2,096 (2021)

State: Western Australia

Location: Perth – Greater Region

Located in the southern region of Western Australia, Karnup is a vibrant suburb offering a blend of rural charm and modern amenities. Situated approximately 55 kilometres south of Perth’s central business district, Karnup enjoys a strategic location near the coastal city of Rockingham and the growing urban hub of Mandurah.

Demographics:

Karnup boasts a diverse demographic makeup, with residents ranging from young families to retirees. The suburb’s population is characterised by long-time locals and newcomers drawn to its relaxed lifestyle and affordable housing options.

Housing:

The housing landscape in Karnup features a mix of established homes, acreage properties, and new residential developments. Families can find spacious properties with room to grow, while first-time buyers and investors are attracted to the affordability and potential for growth in the area’s real estate market.

Amenities and Facilities:

Karnup offers residents convenient access to essential amenities and services despite its semi-rural setting. The nearby towns of Rockingham and Mandurah provide shopping centers, schools, healthcare facilities, and recreational opportunities. Additionally, Karnup itself features local shops, parks, and community facilities catering to its residents’ needs.

Transportation:

Transportation options in Karnup include easy access to major roadways such as the Kwinana Freeway and the Mandurah train line, making commuting to Perth and other nearby areas convenient for residents. Additionally, public bus services serve the suburb, providing further connectivity to surrounding areas.

Natural Attractions:

Nature enthusiasts will appreciate Karnup’s proximity to beautiful beaches, nature reserves, and outdoor recreational areas. Residents can enjoy activities such as swimming, fishing, hiking, and picnicking in the picturesque surroundings of the Peel-Harvey Estuary and Serpentine National Park.

Community Spirit:

Karnup is known for its strong sense of community, with residents actively participating in local events, sports clubs, and community groups. The suburb’s friendly atmosphere and tight-knit community make it an inviting place for people of all ages to call home.

Future Development:

As part of the broader growth and development occurring in the Peel region, Karnup is poised for further expansion and improvement in the coming years. Planned infrastructure projects and residential developments aim to enhance the suburb’s livability while preserving its unique character and natural beauty.

Karnup offers residents a tranquil lifestyle amidst stunning natural surroundings, convenience in urban amenities, and connectivity to nearby urban centres. Whether you’re looking to raise a family, invest in property, or enjoy a relaxed lifestyle, Karnup presents an appealing choice in the Western Australian housing market.

Why Live and Invest in Karnup?

-

Affordable real estate options.

Rural charm with urban conveniences.

Strong sense of community.

Proximity to stunning natural attractions.

Future growth potential.

Excellent connectivity via major roadways and public transport.

Family-friendly environment with parks and schools.

Investment potential for property appreciation.

Want a suitable investment property in Western Australia? Contact us now.

Owning investment properties comes with its rewards and challenges, and one challenge that landlords often face is rental property damage caused by tenants. At Mirren Investment Properties, we understand the importance of safeguarding your investment while ensuring a positive landlord-tenant relationship. In this guide, we’ll delve into the intricacies of navigating rental property damage, empowering you with the knowledge needed to protect your assets effectively.

Understanding Rental Property Damage

Rental property damage encompasses a spectrum of issues, from minor wear and tear to significant structural damage. From carpet stains to broken appliances, and from marks on walls to plumbing issues, landlords must be prepared to address various types of damage promptly.

Tenants’ Liability

It’s essential to differentiate between normal wear and tear and damages attributable to tenant negligence or misuse. While wear and tear is expected over time and is the landlord’s responsibility, damages caused by tenants fall under the tenant’s liability. Examples include broken appliances, stained carpets, or intentional damage.

Addressing Tenant-Caused Damages

Open Dialogue

Communication is key. Initiate a conversation with your tenants to discuss any damages. Providing evidence, such as photographs or repair estimates, can facilitate a constructive dialogue.

Assessment

Evaluate the extent of the damage, and if necessary, involve professionals such as insurance adjusters or legal advisors.

Documentation

Maintain thorough documentation of the damage, including photographs and repair estimates. This documentation will serve as crucial evidence in resolving disputes or pursuing legal action if necessary.

Legal Recourse

In cases of significant damage where tenants refuse to take responsibility, legal action may be required. Familiarize yourself with the procedures outlined by the relevant Residential Tenancies Tribunal in your state.

Prevention and Documentation

Prevention is key to minimizing rental property damage. Conduct a comprehensive property inspection before tenants move in, and document the property’s condition with photographs and detailed notes. Provide tenants with an entry condition report and conduct an exit condition report upon their departure to compare the property’s condition.

Legal Considerations

Understand your rights as a landlord under the Residential Tenancies Act. While you have the right to request tenants to repair damages or pay for repairs, withholding the security deposit requires substantial evidence and adherence to legal procedures.

Landlord Insurance: A Strategic Asset

Consider investing in landlord insurance to mitigate financial risks associated with rental property damage. A comprehensive policy can provide coverage for damages caused by tenants, loss of rental income, and other insurable events, offering you peace of mind.

Key Takeaways for Landlords

Prioritize preventive measures and thorough documentation to safeguard your investment. Familiarize yourself with legal procedures and options for recourse in case of tenant-caused damage. Consider landlord insurance as a strategic asset to protect your investment against unforeseen circumstances. In conclusion, proactive management and informed decision-making are crucial for landlords navigating rental property damage. By staying informed, fostering open communication with tenants, and having appropriate safeguards in place, you can effectively protect your investment and maintain a positive landlord-tenant relationship.

Contact Us Today

Ready to safeguard your investment properties? Contact Mirren Investment Properties today to learn more about our tailored property investment solutions and how we can assist you in protecting your assets.

At Mirren Investment Properties, our clients are at the heart of everything we do. Over the years, we’ve had the privilege of working with seasoned property investors who have accumulated a wealth of knowledge and experience in the real estate market. In this blog, we share the invaluable life lessons our clients have imparted to us, offering insights into what one can learn from their journeys to navigate life more effectively.

Lesson 1: Patience is a Virtue

Our clients understand that success in real estate doesn’t happen instantly. They’ve learned the importance of perseverance and maintaining a long-term outlook. Just as property values appreciate over time, so too do the rewards of patience in life. Whether pursuing personal or professional goals, our clients advocate for patience in achieving lasting success.

Lesson 2: Diversification Mitigates Risk

Diversifying one’s investment portfolio is fundamental to our clients’ strategy, and they stress its importance in life as well. By spreading risk across various assets, our clients mitigate the impact of fluctuations. They encourage diversifying experiences, skills, and relationships to safeguard against challenges and maximize growth opportunities.

Lesson 3: Adaptability Leads to Success

In the dynamic real estate landscape, adaptability is crucial for our clients’ success. They adjust strategies and seize opportunities to thrive. Similarly, in life, our clients advocate for embracing change and remaining flexible to navigate transitions effectively. They view change as a catalyst for growth rather than a barrier to success.

Lesson 4: Applied Knowledge is Power

Our clients prioritise lifelong learning. Success in property investment—and in life—requires continuously expanding one’s knowledge base. By staying informed, they empower themselves to make informed decisions and seize opportunities. They encourage cultivating a thirst for knowledge as a pathway to growth.

Lesson 5: Integrity is Non-Negotiable

Integrity lies at the core of our clients’ values. They emphasize honesty, transparency, and ethical conduct in all dealings. Upholding integrity fosters trust and sustains success. Our clients advocate for maintaining integrity, as it forms the foundation of meaningful relationships and personal fulfillment.

At Mirren Investment Properties, we support you not only in property investment but also in your journey towards fulfillment and achieving your goals and living your dreams. By embracing the life lessons shared by seasoned investors, we empower our clients to navigate challenges with resilience and purpose. Let’s learn from their wisdom and embark on a journey towards success and fulfillment together. Contact us today to begin your journey!

As March 2024 unfolds, property investors are presented with a landscape ripe with potential. Mirren Investment Properties, your trusted partner in navigating the real estate market, is excited to share why this year holds promise for those seeking to build wealth through property investment. Here are five compelling reasons to look forward to the remainder of 2024:

Targeted Investment Strategies for a Dynamic Market

As always, the key to success lies in strategic investing rather than following national averages. At Mirren Investment Properties, we advocate for a tailored approach, focusing on quality properties in high-growth locations. By identifying emerging trends and gentrifying suburbs, investors can capitalize on unique opportunities for long-term wealth accumulation.

Capitalizing on Supply-Demand Dynamics

The persistent imbalance between supply and demand continues to underpin property prices across Australia. With strong immigration fueling demand and limited new construction, established properties retain their value, presenting investors with opportunities to leverage existing equity and secure high-performing assets.

Economic Stability Driving Investor Confidence

Australia’s resilient economy, characterized by low unemployment rates and government infrastructure projects, provides a stable foundation for property investment. Moreover, the expectation that interest rates have peaked offers investors confidence in their long-term financial strategies, fostering an environment conducive to sustainable growth.

Rental Market Resilience

The rental market remains robust, with low vacancy rates and escalating rents enhancing the attractiveness of investment properties. As rental income streams strengthen, investors can enjoy improved cash flow positions, further bolstering the appeal of real estate investment as a wealth creation strategy.

International Investment Inflows Signal Market Strength

The resurgence of foreign investment in Australian property signals market stability and sustained demand for premium properties. As international interest returns, investors can benefit from heightened competition and increased market liquidity, paving the way for enhanced capital appreciation opportunities.

At Mirren Investment Properties, we understand that success in property investment requires strategic planning and expert guidance. Now’s the time to seize the opportunities that lie ahead. Contact us today to schedule a consultation and discover how we can help you achieve your goals and dreams through strategic property investment.

In the fast-paced world of real estate, it’s crucial to stay in the loop with the latest trends and challenges. At Mirren Investment Properties, we’ve got our finger on the pulse, and we’re here to share some insights that could shape your investment strategy. In this blog post, we’ll explore recent developments in the Australian property market and what they mean for investors like you.

Understanding the Landscape

Recent data reveals a decline in new home building approvals across Australia, with a notable drop in apartment approvals. This shift brings both challenges and opportunities for property investors looking to make smart moves in the market.

What Are the Implications for Property Investors?

Limited Supply: The decrease in building approvals suggests a potential scarcity of new properties entering the market. This scarcity could boost the value of existing properties.

Construction Costs: Higher building material costs may impact the profitability of construction projects. Investors should carefully assess the feasibility of new developments in light of these challenges.

Lending Environment: The reduced lending for home construction or purchase may affect the availability and terms of loans for property investors. Staying abreast of the evolving lending landscape is essential for planning future investments.

Navigating the Market

Adapt Your Strategy: Given the changing dynamics, consider adapting your investment strategy to align with the current market conditions. This might involve focusing on existing properties or exploring alternative investment avenues.

Stay Informed: Regularly monitor updates on market trends, government policies, and lending conditions. Being well-informed enables you to make decisions that align with your investment goals.

Mirren Investment Properties – Your Trusted Partner

At Mirren Investment Properties, we’re committed to guiding you through the complexities of the real estate market. Our expert team is well-versed in market dynamics, and we tailor our services to meet your specific investment needs.

Let’s Plan Your Next Move

In this dynamic landscape, strategic decision-making is key. Whether you’re considering expanding your portfolio or seeking advice on existing investments, our team at Mirren Investment Properties is here to assist you. Contact us today to schedule a consultation tailored to your goals and dreams. Let’s navigate the real estate market together and secure a prosperous future!

Median house price: $459,000 (Feb 2023 – Jan 2024)

Past 12 month growth: 13.1%

Median house rental value: $460 PW ((Feb 2023 – Jan 2024)

Transport: Car, train, bus

Population: 3,912 (2016)

State: Queensland

Location: Ipswich – Greater Region

Steeped in history, Leichhardt stands as a testament to Queensland’s past, with each corner telling a story of its own. From quaint cottages to grandiose landmarks, the suburb’s architecture serves as a reminder of its storied past, offering residents a glimpse into bygone eras, and inviting residents to immerse themselves in its rich heritage while enjoying modern conveniences.

Key Highlights:

Historic Charm: Leichhardt boasts a rich historical heritage, characterized by streets lined with character-filled homes and buildings that reflect its past. Residents value the suburb’s unique charm and sense of history, evident in its well-preserved architecture.

Community Spirit: Leichhardt fosters a strong sense of community, with residents actively engaging in local events, markets, and recreational activities. This active participation contributes to a vibrant atmosphere where individuals feel connected and supported within the neighbourhood.

Amenities and Facilities: Leichhardt offers a comprehensive range of amenities, including schools, parks, shopping centres, and medical facilities, ensuring convenience and accessibility for residents’ daily needs. The availability of essential services enhances the overall quality of life in the suburb.

Natural Surroundings: Surrounded by picturesque landscapes, Leichhardt provides residents with ample opportunities for outdoor recreation. From tranquil walking trails to spacious parks and green spaces, the suburb’s natural beauty contributes to a serene and peaceful environment.

Transport and Connectivity: With easy access to major transport routes, including highways and public transportation networks, Leichhardt enjoys seamless connectivity to neighbouring suburbs and the wider Queensland region. Efficient transport options facilitate convenient travel for residents.

Shopping and Dining: Residents of Leichhardt can explore a diverse array of shopping and dining options within the suburb. Local shops, cafes, and restaurants offer a variety of choices to suit every taste and budget, enhancing the overall lifestyle experience for residents.

Family-Friendly Environment: Leichhardt is an ideal suburb for families, boasting quality schools, childcare centres, and recreational facilities tailored to the needs of residents of all ages. The suburb’s safe and welcoming environment promotes family-centric living, contributing to a desirable residential community.

Leichhardt offers a quintessential Queensland living experience, where a rich historical backdrop intersects seamlessly with contemporary amenities and a thriving community atmosphere. Its diverse mix of heritage, facilities, and natural surroundings provides residents with a well-rounded lifestyle, grounded in tradition yet open to progress.

As a suburb that values its heritage while embracing modernity, Leichhardt presents itself as an attractive destination brimming with charm and opportunity within Queensland.

Let us help you find the perfect investment property in Leichhardt, QLD. Contact us now.

For property investors seeking high-yield opportunities, the spotlight is now firmly on Western Australia. In a remarkable shift, Western Australia has surged to second place, surpassing New South Wales as the preferred investment destination in Australia. The key player in this transformation is Perth, where dwelling values skyrocketed by an impressive 15.2% in 2023, marking the highest return in the nation for any major city or regional centre.

Strategic Investment in Perth

As a property investor, it’s crucial to stay ahead of market trends, and the latest data from the Property Sentiment Report for Q4 2023 signals that Perth’s property market is not just a fleeting success. Forecasts predict further price increases well into 2024, making it an opportune time for strategic investments in the region.

Coastal Markets: A Haven for Growth

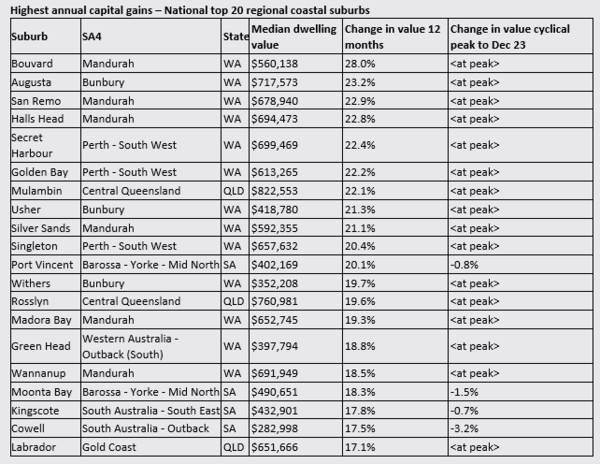

Despite economic challenges, Australia’s regional coastal markets have proven resilient, with over one-third (35%) recording housing values at record highs by the end of 2023. The jewel in the crown is Western Australia, dominating the list of top coastal suburbs with the highest annual capital gains. Mandurah, Perth’s South West, and Bunbury claim more than half of the top 20 spots, showcasing the immense potential for investors seeking both growth and stability.

The Winning Combination: Affordability and Lifestyle

In 2023, the divergence between city and regional property markets became pronounced, and coastal regions were no exception. The top-performing coastal markets in Western Australia and Queensland owe their success to a combination of affordability and lifestyle attributes. Buyers, recognizing the value in these regions, not only rode the upswing but also contributed to the resilience of these top-performing suburbs.

Top 20 Coastal Markets: Where Value Meets Lifestyle

Among the top 20 highest growth coastal markets, every suburb had a median value well under $1 million. These are not just glamorous hot spots but areas that offer a strategic blend of value, lifestyle attributes, and affordability. The opportunity to make a sound investment in areas like Mulambin and Rosslyn, with median dwelling values under $1 million, presents a compelling proposition for savvy investors.

Take Action Today: Contact Mirren Investment Properties

As property investment experts, Mirren Investment Properties recognizes the strategic potential of Western Australia’s property market. Now is the time to explore the opportunities that Perth and its coastal regions offer to investors like yourself.

For personalized insights and guidance on how to capitalize on the thriving property market in Western Australia, contact Mirren Investment Properties. Our team is ready to assist you in making informed investment decisions that align with your financial goals. Seize the moment and unlock the potential of Western Australia’s property boom!

Sources: Property Sentiment Report Q4 2023, Property Pulse, Research News 25th Jan 2024, CoreLogic.

Median house price: $511,500 (Feb 2023 – Jan 2024)

Past 12 month growth: 13%

Median house rental value: $550 PW ((Feb 2023 – Jan 2024)

Transport: Car, train, bus

Population: 22,678 (2016)

State: Western Australia

Location: 23km from Perth CBD

Ellenbrook, situated in Western Australia, offers a harmonious blend of urban convenience and natural tranquillity. This vibrant suburb is renowned for its picturesque landscapes, modern amenities, and strong community spirit.

Key Highlights:

Community Living: Ellenbrook fosters a close-knit community atmosphere where residents enjoy a high quality of life amidst lush greenery and serene parklands.

Amenities and Facilities:The suburb boasts well-planned infrastructure, schools, shopping centres, medical facilities, and recreational amenities, ensuring convenience at every turn.

Natural Beauty: Surrounded by stunning natural landscapes, Ellenbrook offers residents opportunities for outdoor recreation, including walking trails, lakeside picnics, and nature exploration.

Transport and Connectivity: Ellenbrook enjoys easy access to transport options, including bus services and major arterial roads, facilitating seamless connectivity to Perth and surrounding areas.

Shopping and Dining: Residents can indulge in a vibrant retail and dining scene, with a diverse range of shops, cafes, and restaurants catering to every taste and preference.

Family-Friendly Environment: Ellenbrook prioritizes family-friendly amenities, including educational facilities, childcare centres, and recreational activities tailored for families of all sizes.

Ellenbrook embodies the perfect balance between urban convenience and natural serenity, offering residents a peaceful retreat from the hustle and bustle of city life while still enjoying easy access to all modern amenities.

Future Growth and Development

As Western Australia continues to evolve and grow, Ellenbrook is well-positioned for development and expansion. For investors, this presents an opportunity to get in on the ground floor of a suburb with a bright future.

Let us help you find the perfect investment property in Ellenbrook, WA. Contact us now.

In the ever-evolving landscape of property investment, staying informed about economic indicators is crucial. Mirren Investment Properties, committed to providing valuable insights, delves into the latest inflation data and its implications for property investors. CoreLogic’s Head of Research Eliza Owen breaks down the numbers, revealing a potential wave of opportunities for savvy investors.

The Good News on Falling Inflation

The recent Consumer Price Index (CPI) results for the December quarter bring optimistic news for property investors. Inflation has fallen once again, from 5.4% in September to 4.1%, marking the fourth consecutive quarter of decline. This trend indicates softer demand in the economy, with impacts observed in retail trade, job vacancies, and a slight rise in unemployment.

Implications for Monetary Policy

The silver lining in falling inflation lies in its positive implications for monetary policy. A decrease in inflation strengthens the case for interest rates remaining steady in the short term and potentially coming down later this year. A reduction in interest rates is expected to boost housing demand, offering an exciting prospect for property investors.

Housing’s Impact on Inflation

Housing, comprising around 22% of the CPI basket, plays a significant role in inflation calculations. The CPI measure for the purchase of new homes has eased to 5.1%, down from 5.2% in the previous quarter, indicating a favorable direction for property prices. Despite easing, residential construction remains a substantial contributor to inflation, influenced by high labor and material costs.

Rent Component of CPI

The annual growth in the rent component of CPI was 7.3% in the December quarter, showing signs of easing from the previous quarter. While still above the pre-COVID decade average, the slowing rate of increase suggests hope for tenants. CoreLogic rent measures further support this outlook, indicating a potential turnaround in the rental market in 2024.

The Takeaway for Property Investors

Although inflation remains above the Reserve Bank of Australia’s target range of 2-3%, the positive trajectory and faster-than-anticipated decline signal potential relief for property investors. As the economic landscape adjusts, Mirren Investment Properties anticipates a favorable environment for investors with the easing of living costs and a growing expectation of rate cuts later this year.

At Mirren Investment Properties, we are committed to helping you navigate the dynamic world of property investment. If you’re looking to capitalize on the potential opportunities presented by falling inflation, contact us today. Our team of experts is ready to guide you through strategic investment decisions that align with your financial goals. Don’t miss out on the wave – seize the opportunity for growth with Mirren Investment Properties.