We’re all at different stages in our lives. Some of us are married with young kids, some are married with adult children. There are single families, blended families, dual incomes, single incomes, self-employed and employees.

We could go on, but no matter what your finance and life circumstances are, chances are we’ve seen someone just like you and have been able to have an impact on their financial future, more than once.

As you’ll see below, these scenarios outline what we’ve been able to help our clients achieve through property investment.

Single income/sole parent

- Single female, two young teenage kids

- One investment property in Queensland

- Same income, same living expenses as before

- Rental yield is 5.05%

- Reason:

Realised that they need to provide for retirement and pay off home loan as quickly as possible.

- Outcome:

Cash flow positive property, high % of tax returns, will pay $36,000 a year off home loan, will be able to pay off home in six years.

Dual income, less than 50 years old

- Middle class dual income

- One investment property

- Two mature kids

- Rental yield 4.97%

- Reason:

Realised that they did not have enough money in their super for retirement, needed to build up superannuation fast due to age and reduce their home loan ASAP.

- Outcome:

After purchasing investment property: Paid $28,000 off home loan in three months through this investment property and using the tax benefits from the property effectively.

Dual income/older family

- Been with Mirren for seven years

- Four investment properties

- Two kids at university

- $700,000 home debt – home paid off within four years with Rene

- Great success story: husband was unemployed for two years after the GFC, however, due to their buffers and redraw accounts, he was able to continue to live the normal lifestyle, still go on holidays, buy his wife a new car and send his kids to private school whilst on one income. (No properties were sold during this time of financial stress.)

- Furthermore, in two years’ time, two of the investment properties will be paid off.

Business owner

- Self-employed business owner

- Young family

- Three investment properties

- Most recent investment property has a 5.20% rental yield

- Reason:

Paying a lot of tax. Client was referred to us from an existing customer. Having been so satisfied with our products and services, he has referred another seven people to us.

- Outcome:

Reduced tax significantly to single digits per year. Three cash flow positive properties which are helping him pay off the investment debt.

(Home loan is already paid off.) Client would like to set up his kids so that they can purchase their own home in Sydney in a few years’ time.

- Future plans are to do a SMSF property so that he can build up his super and retire at the age of 59.

Young family

- Two investment properties

- Two young kids

- Most recent investment in Goodna, Queensland, is producing a yield of 4.91%

- Reason:

Corporate professional – the client knew he had to invest and reduce his tax but didn’t have the time or energy to do it himself. He came to Mirren from a referral to help him invest properly.

- Outcome:

Mirren was able to source a property, arrange the finance and strategy and help the family settle it with ease. The clients spend only one hour per month in managing their investment properties. They also wanted to renovate their current home and after two years, they are halfway through achieving this goal.

When this renovation is complete, the house price will go from $1mil to $2mil in value. They will be able to send their children to a more prestigious school to receive the education they would like them to have.

See the possibilities

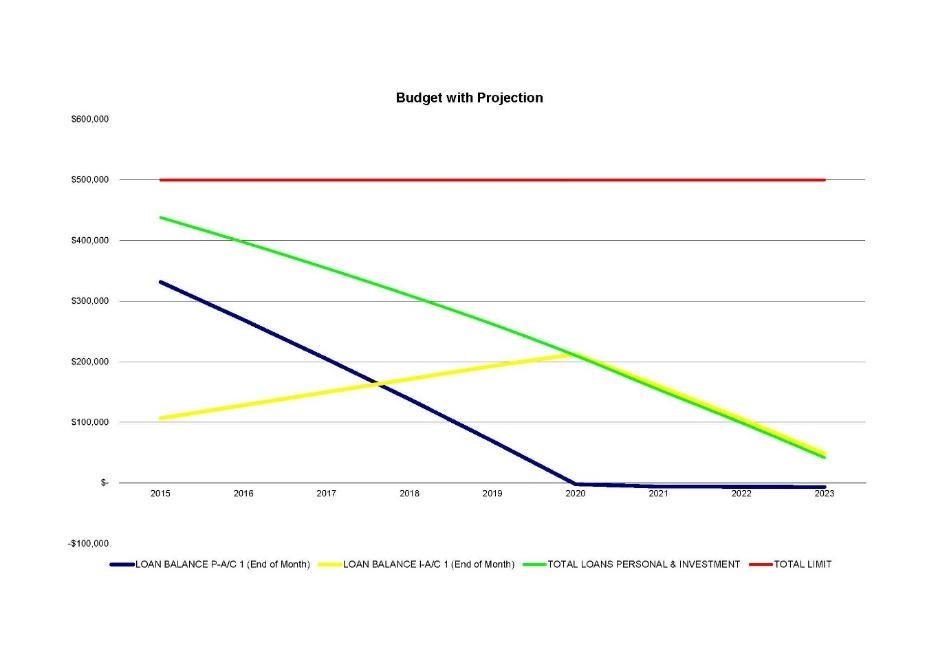

Graph – from a client taken from their budget projections showing paying down of the loans over an eight year period.

Red line is total borrowing limit, personal and investment.

Blue line is showing the home loan being paid off (bad debt).

Yellow line is investment debt including equity from the house (good debt).

Green line is showing overall debt position (good and bad debt together).

The difference between the green line and red line is the equity in a cash format available in the redraw or offset account, accessible at any time for any emergencies (buffer or safety net).