The Australian property market showcased resilience and opportunity in 2023, with the CoreLogic national Home Value Index (HVI) recording an impressive 8.1% surge in home values. While this marked a significant turnaround from the previous year’s decline, it was below the extraordinary surge seen in 2021.

Throughout the year, the market exhibited diversity, with various regions experiencing differing trends. Capital cities like Perth, Adelaide, and Brisbane sustained strong growth rates due to relatively lower housing affordability challenges and lower advertised supply levels. In contrast, larger cities such as Sydney and Melbourne saw a slowdown in growth due to factors like rate hikes, increased living costs, and heightened supply.

The trend favored capital cities, showcasing a robust 9.3% surge in dwelling values compared to the combined regional index’s 4.4% rise. Despite this growth, some capitals still sit below their peak values, presenting potential investment opportunities. Sydney, Melbourne, ACT, Hobart, and Darwin recorded values below their record highs, indicating the potential for growth in these markets.

Key Takeaways for Investors in 2024:

Diverse Opportunities: The market exhibited diversity, offering varied investment opportunities across different regions and cities.

Capital City Potential: Capital cities showed robust growth trends, making them potential focal points for investment due to their higher growth rates compared to regional areas.

Potential for Growth: Capitals like Sydney, Melbourne, and others are below peak values, presenting potential growth opportunities for investors.

Resilience Amidst Diversity: The market demonstrated resilience despite diverse trends, hinting at stability and potential long-term growth prospects.

Considering the evolving landscape of the Australian property market in 2023, the potential for growth, and the diversity of opportunities make 2024 an appealing year for property investment. If you’re ready to explore these opportunities, contact Mirren Investment Properties today to discuss how we can help you make the most of your property investment journey.

The Australian real estate market has been witnessing a sustained surge in property prices, marking an ongoing trend that raises pertinent questions about the future trajectory of the housing market. At Mirren Investment Properties, we delve into the driving forces underpinning this upward momentum and explore why this trend is likely to persist in the foreseeable future.

Supply-Demand Imbalance: A Fundamental Catalyst

One of the foundational drivers behind the soaring property prices in Australia is the persistent imbalance between housing demand and the available supply. The burgeoning demand for residential properties, stemming from population growth, aspirational homeownership, and investment opportunities, far outpaces the rate of new housing construction. This continual shortfall in supply acts as a significant force propelling prices upwards.

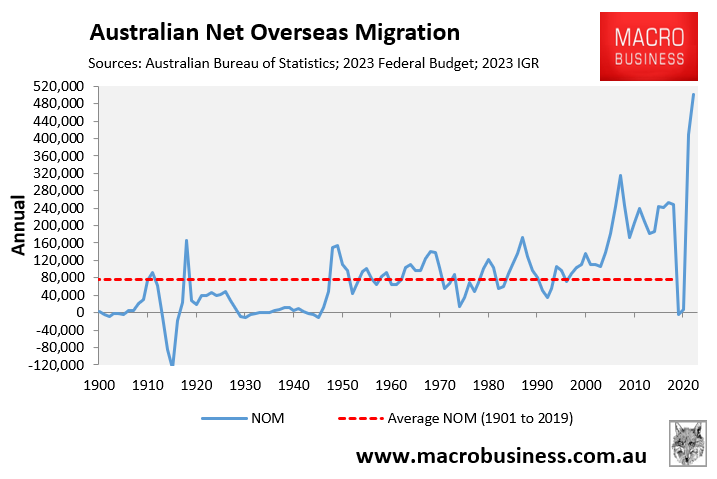

Population Dynamics and Urbanization: Influence of Net Overseas Migration

Source: https://www.macrobusiness.com.au/2023/11/harry-triguboff-panics-after-rba-rate-rise/

Australia’s sustained pace of net overseas migration significantly impacts population dynamics, intensifying the strain on the housing market. Major urban centres, magnets for both local and international migrants, experience heightened demand for housing, significantly surpassing the available supply in these high-demand areas. The resultant pressure contributes substantially to the upward trajectory of property prices, particularly in these sought-after locations.

Investment and Market Sentiment

Investor sentiment plays a pivotal role in influencing property prices. As property continues to be perceived as a secure investment, coupled with historically low-interest rates and alternative investment options, the real estate market remains an attractive choice for investors seeking long-term returns. This sustained interest and confidence in property investment contribute to the buoyancy of prices across the market.

The Mirren Perspective: Navigating Opportunities in an Evolving Market

At Mirren Investment Properties, we understand the intricacies of the Australian property market. Our insights reflect the understanding that this ongoing rise in property prices is fueled by a convergence of factors, primarily the demand-supply imbalance and the impact of net overseas migration on population dynamics.

As we continue to observe this upward trend, we remain dedicated to identifying and presenting investment opportunities aligned with market dynamics. Our commitment is to empower investors by offering astute analysis, informed strategies, and comprehensive market perspectives, enabling them to navigate and capitalize on the evolving landscape of Australian real estate.

For personalized insights and tailored investment strategies, contact our team at Mirren Investment Properties. Contact us now to explore lucrative investment opportunities!

Investing in properties is like navigating a complex puzzle; every piece, every decision, matters. At Mirren Investment Properties, we understand the significance of these choices and are here to guide you through the core principles that can help you unlock success in property investment.

Long-Term Vision

Property investment is not a get-rich-quick scheme. It’s a long-term commitment. Be patient and maintain a long-term vision. Property values can fluctuate, but historically, real estate has shown a tendency to appreciate over time.

Professional Guidance

Property investment is a journey best taken with experienced guides. Mirren Investment Properties offers full-service support, from property strategy, search to acquisition & expansion. Our experts handle the complexities, so you can focus on your investment goals.

Finance Feasibility

Your investment should be a good asset, not a liability. Calculate the costs involved in your property purchase, including the mortgage, taxes, insurance, maintenance, and property management fees. Then, assess the potential rental income and capital growth. We can help you crunch the numbers and ensure your investment is profitable.

Due Diligence

Knowledge is your most powerful tool in property investment. Do your research thoroughly. Investigate the local property market, understand the legal and regulatory aspects of real estate transactions, and be aware of market trends. Our team stays updated with the latest market insights, ensuring you have the information you need to make informed decisions.

Location, Location, Location

You’ve heard it before, and you’ll hear it again because it’s the golden rule of real estate. The location of your investment property can make or break your returns. Consider factors like proximity to schools, transport, amenities, and the potential for growth in the area. Our team has access to properties across Australia, so we can match you with the perfect location for your investment goals.

Property Selection

One size does not fit all in property investment. Your choice of property should align with your investment strategy. Are you looking for high rental yields, long-term capital growth, or a fixer-upper project? We’ll work with you to identify properties that match your goals.

Risk Management

Investing in real estate carries risks, and it’s essential to manage them wisely. Diversify your portfolio, consider different property types and locations, and have contingency plans in place. We can help you create a risk management strategy tailored to your circumstances.

As you embark on your property investment journey, trust us to be your partner, helping you make informed decisions and realise your goals and dreams. Contact us now.

At Mirren Investment Properties, we have been closely monitoring the remarkable resurgence of the Australian property market. The property prices are soaring, defying expectations despite interest rate hikes and economic uncertainties. In this article, we provide a perspective on how migration is emerging as a fundamental driver behind the surge in property demand in Australia.

The Migration Boom Down Under

Australia’s enduring appeal as a global destination is taking centre stage, and migration is playing a pivotal role in this resurgence. Over the years, several factors have contributed to this migration boom.

Population Growth Surpasses Expectations: The Australian government’s forecasts have been upgraded, with the fiscal year expecting a population growth of 2.0%. This increase significantly impacts the demand for housing, which lies at the core of our property investment focus.

Net Overseas Migration: A substantial part of this population growth is attributed to net overseas migration, predicted to reach 400k in 2022/23 and 315k in 2023/24. This influx of people into Australia, driven by its thriving economy and quality of life, has resulted in a surge in housing demand.

The Impact on Property Demand

Migration has a profound impact on Australia’s property market:

Increased Demand for Investment Properties: As people move to Australia, the demand for housing naturally increases. New arrivals, including international students, temporary workers, and permanent residents, require comfortable living spaces. This heightened demand translates to potential opportunities for our property investment portfolio.

Rental Market Growth: The influx of new residents has led to substantial growth in the rental market. As more people seek rental accommodations, rental prices have witnessed a remarkable increase. RBA Governor Philip Lowe’s prediction of rent inflation reaching around 10% per year emphasizes the robustness of this trend.

Supply and Demand Imbalance: The supply of new housing has not kept pace with this population growth. At Mirren Investment Properties, we recognize that this supply-demand imbalance is one of the core reasons behind the continuous rise in property prices. It’s a classic case of strong demand outstripping supply.

The Future Outlook

Considering the current dynamics, we believe that migration will continue to be a fundamental driver of property demand in Australia. This outlook suggests that property prices are expected to maintain an upward trajectory, despite concerns about affordability. For us at Mirren Investment Properties, this presents both exciting opportunities and unique challenges in managing and expanding our property investment portfolio.

Conclusion

At Mirren Investment Properties, we recognize the transformative role that migration plays in the Australian property market. As population growth exceeds expectations and net overseas migration continues to rise, housing demand remains strong. This trend is reshaping the property market, affecting prices, rents, and the overall dynamics of the Australian real estate sector. It reinforces our commitment to providing exceptional property investment opportunities in this dynamic and ever-evolving market.

Contact us now to explore the best property investment options in this dynamic market.

The Brisbane property market has embarked on a promising journey, transitioning into the recovery phase of the property cycle. Notably, it has witnessed seven consecutive months of growth in median property prices, setting a positive tone for the coming years. As we delve into the prospects of Brisbane’s property market for 2023-2024, it becomes evident that this vibrant city is poised to become one of the most robust housing markets in the near future.

The Olympic Spark

One significant catalyst for this positive outlook is Brisbane’s successful bid to host the 2032 Olympic Games. This landmark event will not only bring the world’s attention to the city but also infuse it with newfound energy and opportunities. Hosting the Olympics places Brisbane on the global map, making it an attractive destination for international migrants seeking a unique lifestyle and economic advantages.

The economic benefits of hosting the Olympics are manifold. The event will serve as a beacon, drawing in overseas migrants who are eager to be part of a city with a dynamic and thriving future. Additionally, the Games will create an array of job opportunities, particularly for highly paid knowledge workers, which will further stimulate economic growth and real estate demand in the region.

Population Growth

The federal government’s forecasts paint a compelling picture of Brisbane’s future. It suggests that Queensland’s population is expected to surge by over 16 percent by the time Brisbane welcomes the world to the Olympics in 2032. This projected population growth is a strong indicator of the sustained demand for housing in the city, making it an even more appealing prospect for property investors and buyers.

A Long-Term Perspective

In light of these developments, it’s prudent for potential property buyers to take a long-term view of the Brisbane property market. Instead of attempting to time the market based on where it stands in the property cycle, now might be the ideal moment to establish a foothold in this burgeoning market. If your income is stable and the conditions are favorable for you, consider making a move while others remain on the sidelines. The combination of economic growth, the allure of the Olympics, and a growing population positions Brisbane as a compelling destination for property investment.

Contact Us Now

If you’re intrigued by the prospects of Brisbane’s property market and want to explore investment opportunities, get in touch with us. Mirren Investment Properties is here to guide you through the intricacies of this market and help you make informed decisions. Contact Mirren now to take the first step towards securing your place in Brisbane’s promising real estate landscape.

At Mirren Investment Properties, we are closely monitoring the dynamic landscape of Western Australia’s property market. Recent developments have highlighted a significant surge in population growth within the state. According to the Australian Bureau of Statistics (ABS), WA’s population has seen remarkable growth, reaching 2.855 million residents as of March 2023, with a growth rate of 2.8 per cent, the highest among all states and territories.

In the first quarter of 2023, WA welcomed an astounding 26,005 new residents, marking a substantial 0.9 per cent increase. This surge in population is an exciting development, and we believe it offers strategic opportunities for property investors.

SEIZING OPPORTUNITIES IN THE GROWING MARKET

The increasing demand for housing in WA, particularly in the vibrant city of Perth, has been one of the most noticeable outcomes of this population surge. As property investment experts, we recognize the following trends and their implications:

Capital Appreciation: The heightened demand for homes has led to an upward trajectory in house prices. This presents an attractive opportunity for investors seeking capital appreciation in their property portfolios.

Rental Income Potential: With Perth’s vacancy rate tightening to 0.8 percent in August, the rental market is becoming increasingly lucrative. Investors can expect higher rental income and shorter vacancy periods for their properties.

Favorable Transaction Environment: Homes are selling and leasing at a rapid pace. For those looking to capitalize on their real estate investments, the current market conditions offer a favorable environment.

ADDRESSING LONG-TERM CHALLENGES

While we celebrate the current market dynamics, we are also attentive to the long-term challenges posed by the population growth:

Limited New Construction: The number of new dwelling commencements remains relatively low, with approximately 14,000 expected this year. The apartment market, in particular, faces a shortage of new construction.

Sustainable Growth: To ensure a sustainable and balanced property market, a consistent pipeline of new dwellings is imperative. As property investment strategists, we emphasize the need for sustainable growth to accommodate the expanding population.

In conclusion, we recognize the strategic potential of Western Australia’s population growth for property investors. The current market presents opportunities for capital appreciation and rental income, but it also underscores the importance of addressing long-term housing supply challenges.

Our team is here to guide and support you in navigating this evolving property market. We will continue to provide expert insights and tailored investment strategies to help you make informed decisions and achieve your property investment goals in this thriving environment. If you’re ready to seize these opportunities or have any questions, don’t hesitate to contact us now at Mirren Investment Properties. Stay tuned for more updates and analyses from our team.

Median house price: $470,000 (Sep 2022 – Aug 2023)

Past 12 month growth: 11.9%

Median house rental value: $450 PW (Sep 2022 – Aug 2023)

Transport: Car, train, bus

Population: 2,630 (2022)

State: Western Australia

Location: Peel region of Western Australia

Nestled along the banks of the majestic Murray River in the heart of Western Australia, Ravenswood is a hidden gem that captures natural beauty and historical charm.

Location and Accessibility

Ravenswood is positioned just a short drive south of the vibrant city of Mandurah and about 87 kilometers south of Perth, the capital of Western Australia. This prime location offers residents the best of both worlds: easy access to city amenities and the tranquil allure of a riverside retreat.

Riverside Bliss

One of Ravenswood’s most captivating features is its picturesque location along the banks of the Murray River. This waterway not only provides a stunning backdrop but also offers a range of recreational activities such as boating, fishing, and picnicking. The serene waters are a haven for nature enthusiasts and water lovers.

Rich History

Ravenswood is steeped in history, dating back to the 19th century when it was a bustling gold mining town. The remnants of this era can still be seen in the well-preserved historic buildings and landmarks that dot the suburb. Take a stroll through Ravenswood’s streets, and you’ll feel like you’ve stepped back in time.

Community Spirit

The tight-knit community of Ravenswood is known for its warmth and friendliness. Regular community events, markets, and gatherings create a strong sense of belonging and camaraderie.

Real Estate and Housing

Ravenswood offers a diverse range of housing options, from modern riverfront properties to cosy family homes. Whether you’re looking for a serene riverside retreat or a place to raise a family, Ravenswood has something to suit every lifestyle and budget.

Local Amenities

While Ravenswood exudes a relaxed and tranquil ambiance, it’s not lacking in amenities. The nearby town of Mandurah provides access to shopping centers, schools, healthcare facilities, and a variety of dining options. Ravenswood residents can enjoy the convenience of urban living while still relishing the suburb’s peaceful environment.

Future Growth and Development

As Western Australia continues to evolve and grow, Ravenswood is well-positioned for development and expansion. For investors, this presents an opportunity to get in on the ground floor of a suburb with a bright future.

Let us help you find the perfect investment property in Ravenswood, WA. Contact us now.

Median house price: $840,000 (Aug 2022 – July 2023)

Median house rental value: $650 PW (Aug 2022 – July 2023)

Transport: car, train, bus

Population: 7077 (2021)

State: New South Wales

Location: Lake Macquarie – Greater Region

Nestled in the heart of New South Wales, the charming suburb of Cooranbong beckons with its picturesque landscapes, community warmth, and a lifestyle that effortlessly blends relaxation with opportunity. This suburb profile unveils the hidden treasures and unique facets that make Cooranbong a sought-after haven for residents and visitors.

Location and Accessibility

Cooranbong enjoys a prime location, situated just 110 kilometres north of Sydney and a short drive from the stunning shores of Lake Macquarie. The suburb’s proximity to major transport routes, including the Pacific Highway, ensures seamless connectivity to urban centres while maintaining a peaceful suburban atmosphere.

Natural Beauty

Nature lovers are in for a treat as Cooranbong boasts abundant natural beauty. From serene bushland to sprawling reserves, the suburb offers many outdoor activities. Watagan State Forest, a short drive away, presents opportunities for hiking, camping, and picnicking, making it a haven for adventure seekers and families.

Education Hub

Cooranbong is best known for being home to Avondale University College, a prestigious institution offering a diverse range of academic programs. This education hub attracts students from across the country and contributes to the suburb’s dynamic and culturally rich environment.

Community Spirit

The heart of Cooranbong lies within its strong sense of community. Residents enjoy a close-knit environment where neighbours become friends, and local businesses thrive through support from the community. Regular markets, events, and gatherings foster a lively atmosphere that fosters a strong sense of belonging.

Real Estate and Housing

Cooranbong’s real estate landscape offers a mix of housing options, from quaint cottages to modern family homes. The suburb’s appeal is not just limited to its aesthetic; it’s also a prime destination for those seeking a peaceful retreat while still having access to essential amenities and services.

Cultural Gems

While Cooranbong is a serene haven, it’s not short on cultural and leisure options. The town boasts a historical museum that delves into its rich past, and nearby Lake Macquarie offers aquatic activities, including boating, fishing, and kayaking. Plus, the proximity to the Central Coast ensures that entertainment, dining, and shopping options are always close enough.

Future Growth and Development

As urban centres expand and lifestyles evolve, Cooranbong stands poised for growth. Its natural beauty, educational institutions, and community spirit make it an attractive destination for families, retirees, and professionals seeking a balanced lifestyle away from the hustle and bustle.

Cooranbong, NSW, is more than just a suburb; it’s a lifestyle choice that offers a harmonious blend of nature, education, and community. With its idyllic setting, opportunities for growth, and serene ambience, this suburb continues to capture the hearts of those who seek a slice of tranquillity within reach of urban conveniences.

Let us find you a great investment property Cooranbong, NSW. Contact us here.

Suburb Profile: Angle Vale, South Australia

Located in the northern outskirts of Adelaide, Angle Vale is a thriving suburb that offers a perfect blend of rural charm and modern amenities. With its picturesque landscapes, close-knit community, and convenient access to urban conveniences, Angle Vale has become a sought-after destination for families, professionals, and nature enthusiasts alike.

Location and Connectivity: Situated approximately 37 kilometers from the Adelaide Central Business District, Angle Vale enjoys a strategic location that combines tranquility with easy access to city amenities. The suburb is well-connected to surrounding areas via major roads, including the Angle Vale Road, Curtis Road, and the Northern Expressway. Residents can conveniently commute to the city or explore the nearby towns and attractions.

Lifestyle and Community: Angle Vale exudes a warm and welcoming community spirit, making it an ideal place to raise a family or establish roots. The suburb boasts a range of community facilities, including parks, playgrounds, and sports fields, providing ample opportunities for outdoor activities and recreational pursuits. The local community center serves as a hub for social gatherings, events, and programs, fostering a sense of belonging among residents.

Education: Families with children will appreciate the educational opportunities available in Angle Vale. The suburb is home to Angle Vale Primary School, which provides quality education and a nurturing learning environment. Additionally, nearby schools in surrounding suburbs offer a range of public and private educational options to cater to diverse needs and preferences.

Real Estate: Angle Vale offers a mix of lifestyle options, from expansive rural properties to modern residential developments. The suburb has witnessed significant growth in recent years, with new housing estates and land releases catering to various budgets and preferences. Whether you’re seeking a spacious acreage property or a contemporary family home, Angle Vale presents a range of real estate opportunities to suit different lifestyles.

Natural Beauty and Recreation: Nature enthusiasts will revel in the natural beauty and open spaces that Angle Vale has to offer. The suburb is characterized by sprawling farmland, scenic vistas, and pockets of conservation areas. Residents can enjoy leisurely walks or bike rides along the meandering trails, explore nearby parks, or indulge in outdoor activities amidst the picturesque backdrop of the surrounding countryside.

Retail and Amenities: While Angle Vale offers a peaceful rural setting, essential amenities and conveniences are within easy reach. Residents have access to local shops, supermarkets, and services for day-to-day needs. The nearby Gawler town center and Munno Para Shopping City provide a wider range of retail options, including shopping centers, restaurants, entertainment venues, and healthcare facilities.

Angle Vale presents a unique lifestyle proposition, combining the tranquility of rural living with proximity to urban amenities. With its strong community spirit, natural beauty, and convenient location, this suburb continues to attract those seeking a balanced and fulfilling lifestyle.

Invest in Angle Vale with Mirren. Let us match you with a property that perfectly aligns with your property investment goals. Contact us for a no-obligation complimentary strategy session.

In recent years, as property prices have soared in many desirable locations, a new trend has emerged in the real estate market called rentvesting. This strategy allows individuals to live in their preferred areas while investing in property elsewhere. Rentvesting has gained popularity as an alternative path to homeownership and investment, but like any strategy, it comes with its own set of advantages and disadvantages. In this article, we will delve into what rentvesting entails and explore its pros and cons.

What is Rentvesting?

Rentvesting, a blend of “renting” and “investing,” involves renting a property to live in while simultaneously investing in real estate in a different location. Instead of purchasing a home in an expensive or unaffordable area, individuals choose to rent a property in their preferred location and invest their money in more affordable or promising real estate markets. Rentvesting allows individuals to balance their lifestyle choices with long-term financial goals.

Pros of Rentvesting:

-

Lifestyle Flexibility: Rentvesting offers the freedom to live in desirable areas where property prices may be out of reach for many buyers. It allows individuals to enjoy the amenities, proximity to work, and vibrant social scenes without compromising their lifestyle preferences.

Investment Opportunities: By investing in more affordable or high-growth areas, rentvestors can diversify their property portfolio and potentially benefit from capital appreciation. They can leverage rental income from their investment properties to build equity and create wealth over time.

Financial Agility: Rentvesting provides individuals with the flexibility to adapt to changing life circumstances more easily. It allows them to move for job opportunities, lifestyle changes, or personal preferences without the constraints of being tied to a property.

Tax Benefits: Rentvestors may take advantage of tax deductions on expenses related to their investment properties, including mortgage interest, property management fees, repairs, and depreciation. These deductions can help reduce taxable income and increase overall financial returns.

Cons of Rentvesting:

-

Dual Financial Commitments: Rentvesting requires individuals to manage both rental payments for their primary residence and mortgage payments for their investment properties. This dual financial commitment can be challenging, especially if rental income doesn’t fully cover mortgage repayments.

Limited Control: As a renter in their primary residence, individuals may face restrictions imposed by landlords, such as limitations on renovations or changes to the property. This lack of control over the living environment can be a disadvantage for those seeking complete autonomy in their home.

Property Market Risks: Investing in real estate comes with inherent risks, such as fluctuations in property prices, economic downturns, or changes in rental demand. If the investment properties underperform or experience prolonged vacancies, it can impact the financial stability of the rentvestor.

Emotional Disconnect: Rentvesting means individuals may not have the emotional attachment to their primary residence that homeowners typically experience. This lack of emotional connection can impact the sense of stability and security that comes with owning a home.

Rentvesting has emerged as a viable option for those seeking a flexible lifestyle and investment opportunities in the property market. It offers the chance to live in desirable areas while building a property portfolio elsewhere. However, it’s crucial to carefully consider the pros and cons before embarking on this strategy. Rentvesting requires financial discipline, research into promising investment markets, and a clear understanding of individual goals and risk tolerance. By weighing the benefits against the potential drawbacks, individuals can make an informed decision on whether rentvesting aligns with their long-term aspirations.

Need advice on what is the best investment property strategy for you? Contact Mirren now.